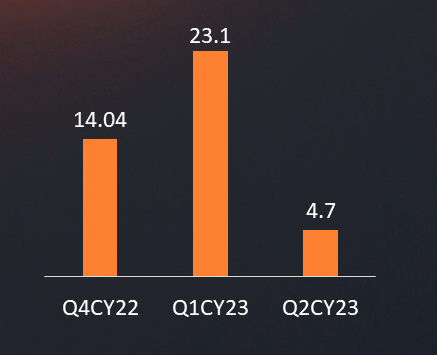

Pakistan’s startup ecosystem has experienced significant challenges in recent times. The first half of 2023 saw a sharp decline in funding, with the sector raising only $28 million, a staggering 90% drop compared to the same period in the previous year.

QoQ Deal Value ($Mn)

Number of Deals, Sector-wise

During this quarter, the overall number of deals has remained relatively stagnant. However the average deal size shrunk to $0.94 million from $3.3 million in Q1CY23. Notable deals in this quarter include Fintech startups such as GoldFin securing $2 million and Neem raising $1 million in funding. Additionally, smaller Pre-Seed and Accelerator level deals were struck by Apollo Group, Qist Bazaar, OkayKer, and Pattern App.

Deal Count by Round

Top Deals

Global Funding Trends

The scenario in Pakistan is not completely in isolation. Notably, the global venture funding landscape has also seen a slowdown during the same period. Crunchbase data shows that global funding reached nearly $22 billion in May 2023, significantly down, approximately 44%, compared to May 2022. This trend indicates a cautious approach from investors, as they pare back their funding pace in response to the uncertain economic climate.

The decline in Pakistan’s startup funding aligns with the global trend. In key markets such as the US, the UK, and China, VC funding deals saw significant drops in both volume and value. From January to April 2023, the US witnessed a 44.3% decline in deal volume, while the UK and China experienced decreases of 29.4% and 19% respectively. The decline in value was even more pronounced, with reductions of 51%, 53.2%, and 44.3% for these markets respectively.

Understanding the Macroeconomic Situation

Pakistan has endured what many consider its most challenging year yet, marked by the looming threat of default. This uncertainty has been a significant deterrent for potential investors, who naturally shy away from making substantial bets in such an environment.

IMF Deal and Economic Recovery: Amidst these difficulties, there is a glimmer of hope for Pakistan’s economy. The country has recently reached a staff-level agreement with IMF for $3 billion of funding, pending board approval.

The inflation rate in Pakistan, which had reached a record high of 38% in the previous month, showed signs of relief in June 2023. The annual inflation rate decreased to 29.4%, marking the first decline in seven months. While this improvement is modest, it demonstrates the potential for stabilization and sets the stage for gradual economic recovery.

Conclusion

Pakistan’s startup ecosystem has faced significant challenges, reflected in the decline in funding during the first half of 2023. However, this setback is not unique to Pakistan, as global venture funding has also experienced a slowdown. The macroeconomic situation in Pakistan, including the threat of default, has understandably deterred investors. Recent developments, such as the IMF agreement and easing inflation, provide hope for economic recovery.

Taking a broader perspective, it’s worth mentioning the interest shown by top venture capitalists like Tim Draper in countries facing economic turmoil like Sri Lanka, referring to it as a “Troubled Nation” with the potential to become a “Startup Nation”. Recognizing the strength of its labor force and high literacy rate, Draper emphasizes that “Entrepreneurs can be the little ripple that turns a tidal wave of economic growth”. Likewise, Pakistan with its substantial young population and increasing broadband penetration, holds immense potential to become the next startup hub in the region.

Sarwat carries a diverse portfolio, skills and knowledge expertise of both Technology and Finance.